vermont state tax exempt form

Provide vendor with federal exemption IRS determination letter PDF in. What Does Tax Exempt Mean.

How To Register For A Sales Tax Permit In Vermont Taxjar

Office of Veterans Affairs 118 State Street.

. Form S-3C Vermont Sales Tax Exemption Certificate For Contractors Completing a Qualified Exempt Project 27788 KB File Format. Exemption for Advanced Wood Boilers. Discrepancy Reference Guide for Vermont Form IN-111.

Tennessee TN Exempt from Sales and Use tax. Wednesday March 16 2022 - 1200. Montpelier VT 05620-4401 Or Fax to.

Who do I contact if I have questions. Vermont Tax Exempt Form Agriculture. Free Tax Help for Vermonters.

185 rows This booklet includes forms and instructions for. 32 VSA 9741. State government websites often end in gov or mil.

Thursday January 23 2020 - 1200. If a Gift Tax Exemption claim is submitted with a registration or title and tax application that. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax.

Standard Contract form template for Services. To apply as a Vermont resident for an exempt vehicle title on a vehicle that is more than 15 years old. IN-111 IN-112 IN-113 IN-116 HS.

Before sharing sensitive information make sure youre on a state government site. Standard Contract for Services 07-28-2022 Revised Standard Short Form. Agricultural Machinery Equipment and Supplies.

Vermont Tax Exempt Form Agriculture Taxes Exemption Forms arrive in a number of types. September 1 2022 by tamble. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000.

120 State Street Montpelier Vermont 05603-0001. The exemption level varies from town to town. Submit a completed Certification of Tax Exemption form VT-014 with a completed Registration or Tax Title application VD-119.

Tax Exempt Form Vermont 2022 Income or transactions not subject to federal state or municipal taxes are tax-exempt. Vermont Sales Tax Exemption Form Income tax Exemption Varieties arrive in a number of varieties. 53 rows No reciprocity with State of Vermont per 1-800-TAX-9188.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. B-2 Notice of Change. Make Model Year YYYY.

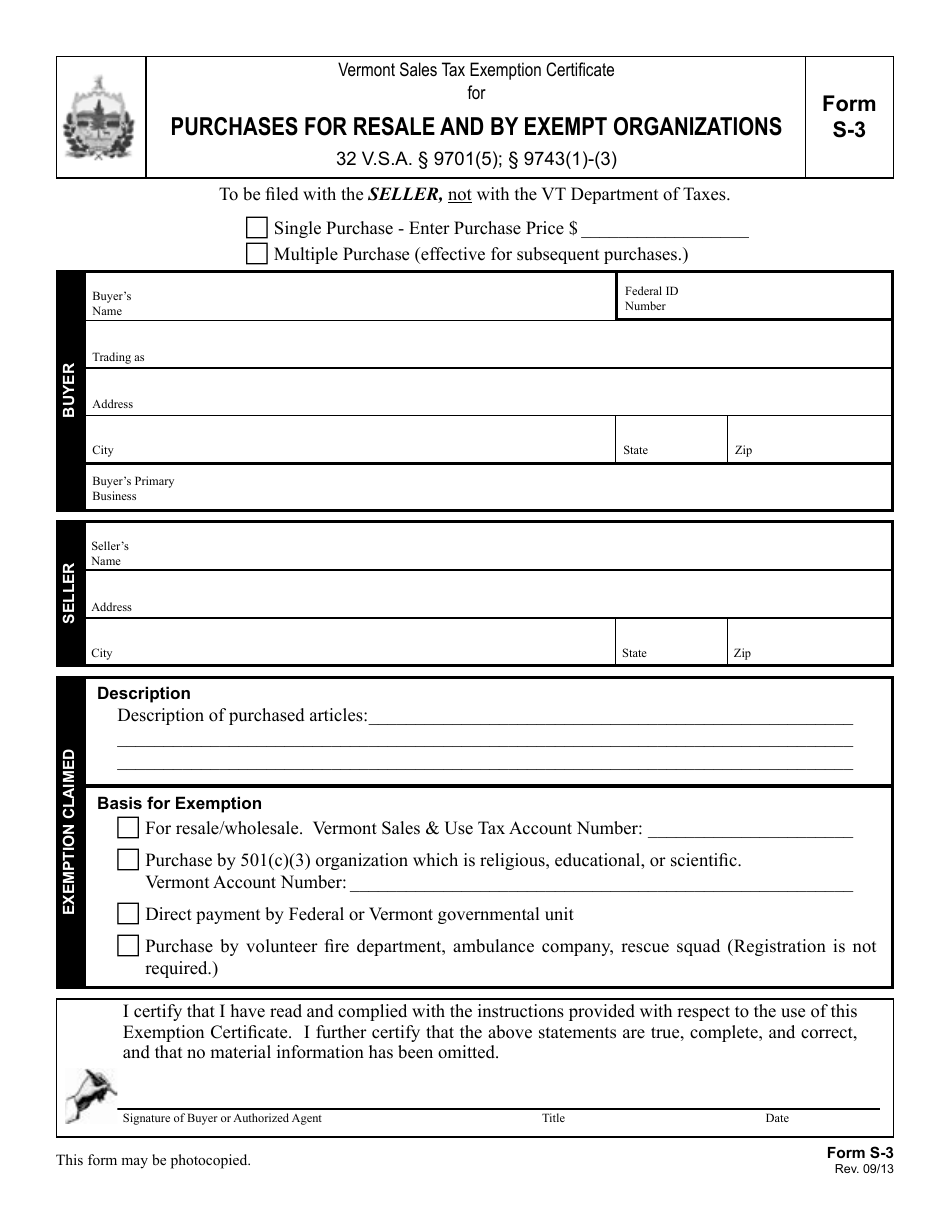

802-828-5932 In-State toll free 888-666-9844. Vermont Sales Tax Exemption Certificates. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit.

Rev1119 Vermont Sales Tax Exemption Certificate for CONTRACTORS COMPLETING A QUALIFIED EXEMPT PROJECT listed below 32 VSA. How to use sales tax exemption certificates in Vermont. MAY 1st Deadline by State Law Mail to.

Form S-3C This form may be photocopied. Standard Short Form 12122018 Revised. Yes a form is required for Purchase Card transactions.

When you use a Government Purchase Card GPC such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state. Examples of proof of registration are. Act 194 S276 Secs.

These include the Contractors Exemption Certificate Assistance in Fight. Vermont Department of Taxation.

Vermont Sales Tax Exemption Certificate For Form S

Resale Certificate Requirements For Tax Exempt Purchases

Vermont Retirement Tax Friendliness Smartasset

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Form S 3a Fillable Agricultural Fertilizers Pesticides Machinery And Equip

Tax Vermont Exempt Fill Out Sign Online Dochub

Migrants To Vermont Have More Income Than Those Who Leave Public Assets Institute

Download Business Forms Premier1supplies

Sales Tax After The Wayfair Decision And How It Impacts You Youtube

Fillable Online Form S 3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print Pdffiller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Free Vermont Boat Bill Of Sale Form Pdf Eforms

Vermont Dmv Forms Etags Vehicle Registration Title Services Driven By Technology

Sales Tax Exemption For Building Materials Used In State Construction Projects

Vermont Military And Veterans Benefits The Official Army Benefits Website

Download Business Forms Premier1supplies

Free Vermont Quitclaim Deed Form Legal Templates